More and more businesses are beginning to go cashless, which is unsurprising, especially since cash transactions have been on a steady decline over the past decade. From 50% in 2010 to only 17% in 2020, cash use is at an all time low. Many researchers on the topic have attributed this decline to many reasons; efficiency, rewards, and even a research paper by the Bank for International Settlements (BIS) claims that this was accelerated by the Covid-19 Pandemic. This alarming fact has increasingly begun to create fear within those who have concerns over a potential cashless society.

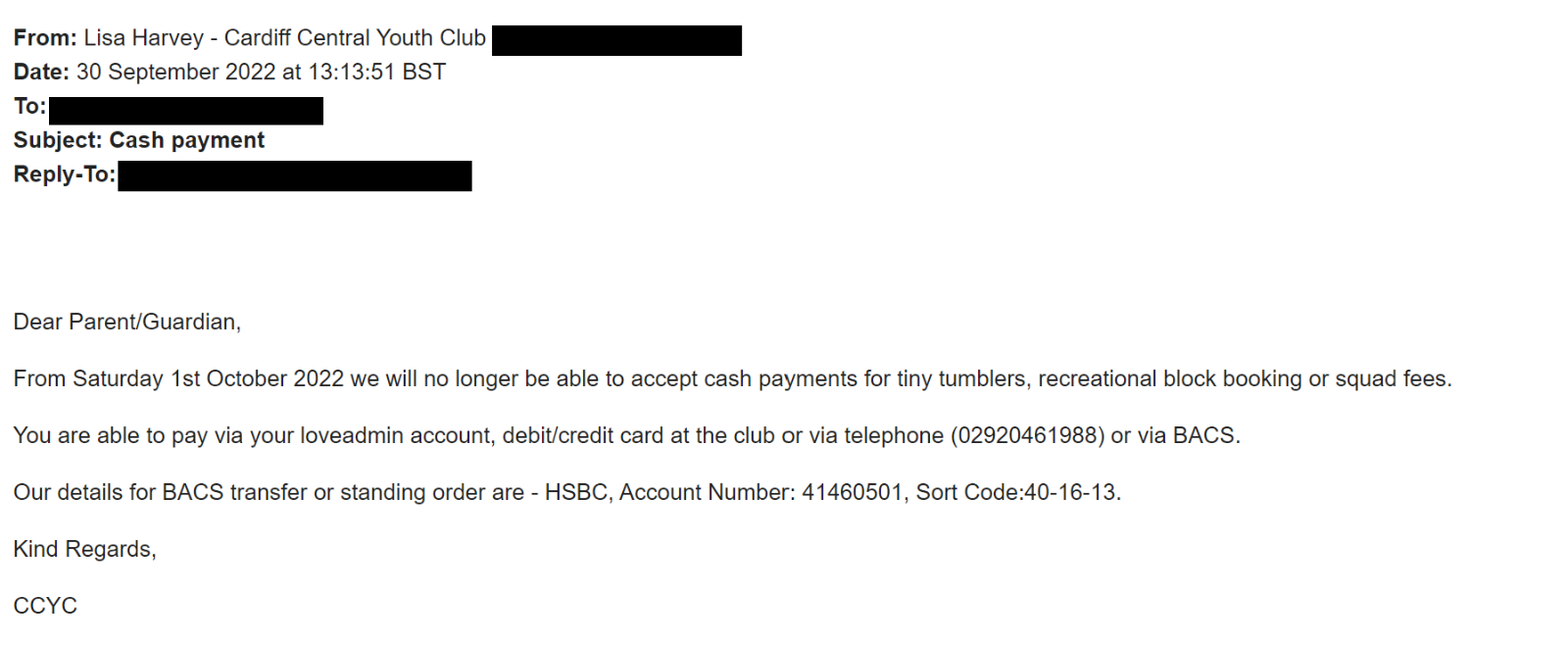

A furious Grandmother reached out to us to explain that she recently received an email from the Cardiff Youth Club saying from the 1st of October they will no longer be accepting cash as a legal tender or form of currency.

The Cardiff Central Youth Club is a gymnastic facility aimed towards young people. Originally, this was privately owned, but recently the council bought it, which weirdly enough is around the same time they decided to go cashless.

The furious Grandmother, who asked to remain anonymous, told Voice of Wales she was in, “shock, followed by anger. Anger, because she believes this is the means to an end… the death knell for cash” further explaining, “I am only too aware of the implications of a cashless society, the implications of which are too awful to contemplate. I could go on, but I fear I’d be condemned as a ’conspiracy theorist’!”

She further elaborated saying, “we’ll be living in a ‘digital prison’, according to many a financial expert.

“One thing’s for sure, financial privacy will be a thing of the past as the government/state will know every financial transaction you make, hence no more cash jobs on the side, which in turn will create economic hardship for many.

“Reliance on 100% digital payments make us more susceptible to fraud because despite reassurance from tech companies, hackers are always one step ahead, so it seems.”

Furthermore, Debbie Hicks, founder of Keep it Cash, is looking to fight against this so-called ‘cashless society’. We asked her what she thought of the council being the ones to push this cashless agenda, in this instance, she answered, “if this is true, the public and consumers deserve answers as to who is telling or demanding the council push a cashless society. Business owners that will lose their livelihoods deserve to know.”

Hicks, also commented on why she believed it is important for businesses to use cash as well as card, “there’s a common myth being perpetrated that handling and working with cash is more expensive and safer for businesses, but when we look further we find this is not true. Credit and debit card readers cost a lot when you have increasingly high overheads. More and more businesses are asking customers to pay in cash to offset these charges. There are bank accounts that are cash friendly – with low charges for depositing and withdrawing cash.

“Millions still get paid in cash. Businesses that go cashless are shutting out millions of their potential customers and revenue they need.”

She went on, “contactless and card/digital fraud is statistically higher than fraud or criminal activity with cash for shops and small businesses. I used to run a café and it’s important to run a till responsibly – asking someone trustworthy to manage cash and cashing up to take to the bank.”

The Cardiff Central Youth Club ignored our repeated requests for comment on the situation.

0 Comments